BizFlex Loan: Fuelling Catering Shop Online’s Growth Story

Standard Bank's BizFlex provided Catering Shop Online with a flexible, unsecured loan, allowing the company to increase inventory, expand operations, and achieve 400% growth.

The context

Established in 2014, Catering Shop Online is a catering equipment retail business with an e-commerce store and a showroom in Centurion, Tshwane.

The problem

Like any retail business, sizable cash injections are required to buy and replenish stock to grow. Prior to using BizFlex, our client was experiencing these challenges:

- Growth constraints: In the case of Catering Shop Online, importing goods from Turkey, China, and India required upfront payments to international suppliers and logistics firms to ship containers of goods. Having limited cash on hand to invest in inventory constrained the business’s growth. This made it challenging to meet customer demand, potentially leading to lost sales and opportunities.

- Difficulty accessing capital: The business also struggled to secure traditional bank loans due to a lengthy application process and the need to provide a significant amount of documentation. This created friction and delays in the application process, limiting its ability to invest in inventory and expand its operations.

“When I started, I did approach a few banks to get finance, and believe me, it was very difficult. With BizFlex, we’ve never had that problem. It was so simple. At the touch of a button, the money is in your account.”

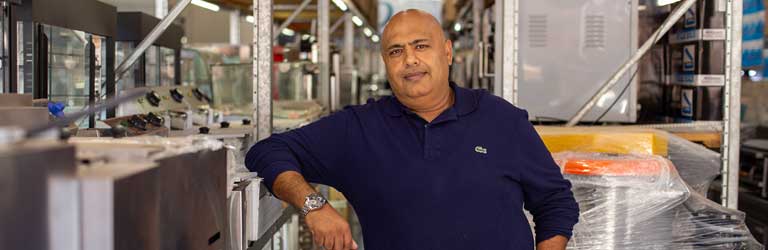

– Asiem Alli: Founder & CEO, Catering Shop Online

The solution

Catering Shop Online took up Standard Bank’s innovative, unsecured loan, BizFlex, and enjoyed the following benefits:

- Pre-approved and fully digital: Clients are pre-approved and simply need to complete the quick digital take-up and signing process online. On approval, funds are paid out within hours, making it much easier and quicker than traditional bank loan applications.

- Pay-as-you-earn flexibility: The unique benefit of this repayment structure is that it’s directly linked to a percentage of total revenue earned, matching the business’s cash flow cycles.

- Cost certainty: A fixed and guaranteed 'all-in' cost structure that does not change, irrespective of the time taken to repay the loan. This cost transparency, along with no additional monthly fees or penalty fees, provides certainty to SMEs when borrowing, ensuring there are no unwelcomed surprises.

- Access to additional funds: While still repaying an active BizFlex loan, qualifying businesses can access additional funds on approval with the automated ‘top-up’ feature.

“With BizFlex, before you take out the loan, you can choose the amount you want to pay back as a percentage of your revenue. So, you are in charge, and you know exactly what the loan is costing you. There are no surprises. At the end of the month, there is no debit order because your BizFlex loan repayment has been taken off your account already.”

– Asiem Alli: Founder & CEO, Catering Shop Online

The outcome

Since taking up the initial facility in July 2019 and accessing additional funds through the automated top-up feature, Catering Shop Online has achieved 400% growth along with the following positive outcomes:

- Expanded operations: The business has grown from 10 to 30 employees and increased its warehousing from two to six locations.

- Improved inventory management: BizFlex has enabled the company to purchase more inventory from overseas suppliers, allowing it to offer its clients a wider selection of products.

- Strategic purchasing: Having cash on hand has helped our client improve margins by strategically timing the purchasing of equipment when goods are on sale and negotiating favourable discounts on cash deals.

- Diversified business model: The company's immediate access to capital has also enabled it to establish a new division that buys and refurbishes used and demo equipment for resale.

“I’ve grown my business by over 400%. BizFlex is so simple and easy. It’s the best way of getting money quickly and hassle-free. If it wasn’t for BizFlex, I wouldn’t be where I am today.”

– Asiem Alli: Founder & CEO, Catering Shop Online