Protect your business from fraud with Standard Bank’s Escrow payment platform

Any business that participates in a transaction with an unknown entity may be vulnerable to payment fraud.

The number of scams and incidents of online and transactional fraud in South Africa have skyrocketed, even more so in recent months.

“Fraudsters thrive in times of crisis,” says Kuben Chetty, Head: Client Solutions, Everyday Banking at Standard Bank. “The COVID-19 crisis has created many new opportunities for fraudsters to exploit the vulnerability of businesses, who have become reliant on digital platforms to buy and sell products and services.”

From deposit and refund fraud, to goods scams and tender and fraudulent instruction scams – where a business transfers funds as a result of fraudulent instructions from a person purporting to be a vendor – incidents of online and transactional fraud in South Africa are on the rise and could cripple a business.

“Cybercriminals and fraudsters use various, sophisticated means to misrepresent themselves or their actions in an effort to defraud businesses who trade with unknown entities, which could result in detrimental operational and financial losses for a business,” says Chetty.

Businesses that trade in goods or services are often involved in transactions that require them to make deposits or full upfront payments. As this transaction is between strangers, there is a lack of trust between parties, which can be unsettling. The same can be said for sellers who offer a product or service without the certainty that the buying party has the agreed funds.

“These issues, among others, have raised the need for a secure payment mechanism that ensures our clients can safely partake in transactions that are traditionally risky, highly susceptible to fraud, and where there is a lack of trust between transacting parties,” says Chetty.

In recognition of the need for protection against payment fraud, the risk of non-payment or the hassle of chasing payments, Standard Bank launched a digital Escrow platform enables buyers and sellers who are trading in goods or services to transact in a secure environment facilitated by the bank.

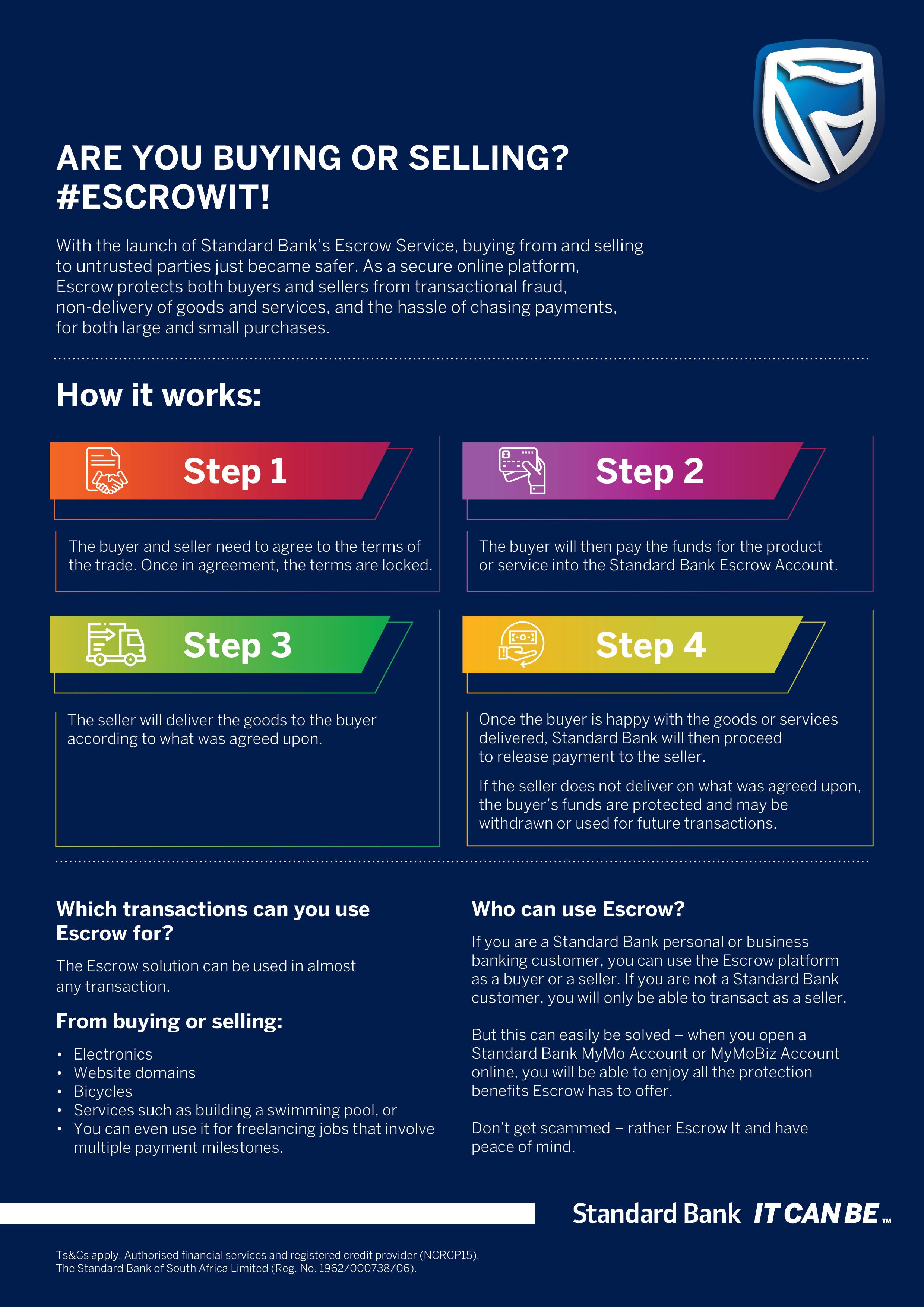

‘Escrow’ is an arrangement where a third-party, in this case, Standard Bank, safeguards funds on behalf of two transacting parties until all obligations and terms of the agreement are met. When the buyer is satisfied with the goods or services provided, Standard Bank releases the funds to the seller. In this case, buyers are protected from non-delivery and sellers have the certainty that a buyer has the agreed funds to conclude the transaction.

When two parties transact on the platform, a buyer makes payment into the Standard Bank Escrow account and funds are only released to the seller once delivery of the goods or services to the buyer has been completed and the buyer is satisfied based on the contract / agreement between both parties. If the seller misrepresents themselves, they will not be paid, and a buyer will have protection against this.

Benefits for businesses when transacting via Standard Bank’s online platform:

- Free registration and a competitive Escrow fee structure.

- Reduced time to process a transaction, depending on the speed of transacting parties.

- Email and SMS notifications sent to all parties during each stage of the transaction process. This ensures transparency and visibility of transaction progress.

- The ability to split a single transaction into separate milestones or progress payments. These are common in the fuel, commodity, construction, and freelancing sectors. Payment is released after the successful completion of certain milestones.

“With Standard Bank’s digitised Escrow service, transacting parties have peace of mind against non-delivery due to the protection benefits offered by the service. The payment platform allows users to harness opportunities by partaking in transactions they would not have done previously without Escrow,” concludes Chetty.

For more information on how Escrow works, see below: