Balloon payments: The pros and cons

Dreaming of a new car but worried about the monthly payments? A balloon payment can be used strategically to finance a new vehicle, but while the short-term benefits are appealing, it should still be considered within the context of your affordability.

Furthermore, the looming lump sum payment at the end of the loan period must always be kept in mind as it will have an impact on your payments later. It’s a financial tool that requires careful consideration and a clear understanding of its implications.

Here’s what to consider when making an informed decision to buy a vehicle:

What is a balloon payment?

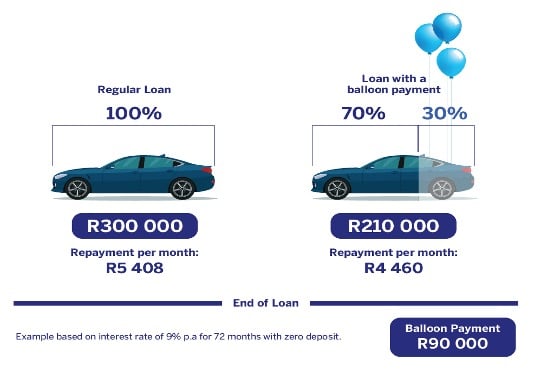

Unlike regular vehicle financing, a balloon payment is a type of car loan where you pay lower monthly instalments for a period, covering a percentage of the loan amount, and then at the end of that term, you owe a large lump sum which you agree to pay back.

This can make a new(er) vehicle more accessible by reducing the immediate financial burden. However, it's crucial to understand that this reduced monthly cost comes with a trade-off: a large lump sum payment, often called a balloon payment, is due at the end of the loan term.

This means the bank still owns your vehicle until the balloon payment is paid back in full. This final payment can be significant and requires careful planning, making it important to factor into your ownership expectations.

When does it make financial sense?

The purpose of a balloon is to make your monthly payments more affordable, taking pressure off your budget. The benefit is that you can drive away with a new car, have a smaller initial debt owed and have an extended period to pay off the car.

This can be particularly attractive if you anticipate an increase in income or have other financial obligations that you need to prioritise in the short term.

A balloon payment can work for you if

- you have the means, or you’ve budgeted the money you saved on the monthly repayments,

- you’re planning to put the money you save on your car payment towards the outstanding amount owed or use it to pay off other debt and free up cash flow, or

- you’re expecting a bonus or tax refund that you could earmark for the balloon payment.

A note of caution: Be careful of relying on uncertain future income streams as this could be financially risky.

What to look out for

It’s important to remember that at the end of the initial repayment period, you still need to pay an outstanding amount. Therefore, it’s still under the bank’s ownership until you’ve paid off the residual amount. This means you can’t sell the car outright without settling the balloon payment first with the bank.

It’s critical to consider the long-term affordability of paying for this vehicle: can you afford the ongoing costs, or will the continued expense influence your ability to reach your financial goals?

Beyond the monthly payments and the balloon payment itself, factor in expenses such as insurance, maintenance and fuel. These costs can add up quickly and impact your overall affordability.

Planning on buying a car?

Use our vehicle finance calculator to estimate what you can afford and what your potential monthly repayments could be.

Remember to factor in all associated costs, not just the monthly payment, when using the calculator. A seemingly affordable monthly payment can quickly become a burden if you haven't accounted for the balloon payment and other expenses.

Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.