Your money and interest rate drops

Interest rates are like the tide of the financial world, constantly changing flow due to various complex factors, including inflation, economic growth and monetary policies set by the South African Reserve Bank to control money supply and stimulate or curb economic activity.

Interest rates represent the cost of borrowing money from financial institutions; think of it as a fee you pay for using someone else's funds. Therefore, when interest rates are high, borrowing becomes more expensive, and when they drop, it becomes more affordable.

Interest rate cuts are good news for your budget and financial capacity to do more with your money. Here's why and how you can use it to your financial advantage:

Loans become more affordable

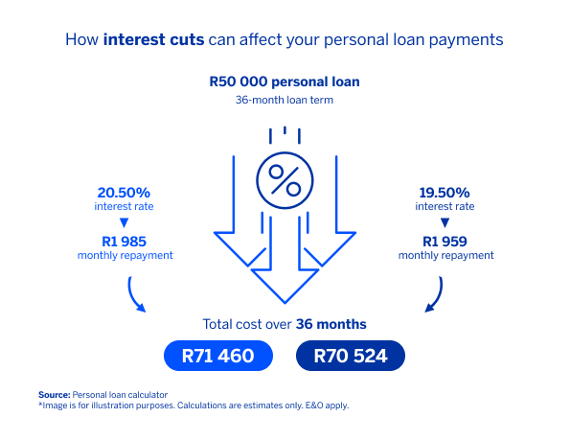

Lower interest rates mean you'll enjoy smaller instalments on your loan and pay less in interest over the life of the loan. Whether it's a personal loan, car loan or your bond, it means keeping more money in your pocket and freeing up cash for other things, such as saving more or paying off debt.

Increased borrowing power

With lower interest rates, you might qualify for a larger loan amount than you would have before, making your financial goals more attainable. This is because your monthly payments will be lower, making it easier to manage a bigger loan. This can translate to significant savings, making it easier to borrow for that home renovation you've been putting off or finally buying that new car.

Greater spending power

When interest rates are reduced and your loan instalments become less, it becomes cheaper to borrow money. Not only does this mean that you’ll pay less interest over time, but it also creates wiggle room in your budget, increases your ability to save or invest for the future and gives your spending a boost to enjoy the now.

Debt consolidation becomes attractive

If you're juggling multiple or high-interest debts (such as older loans or credit cards), a decrease in interest rates presents the opportunity to refinance your debt through consolidation. You can refinance your existing debts into a new, single loan with a lower interest rate, simplifying your payments and saving you money on interest charges.

Time to lock in lower rates: While interest rates are low, it's a good time to lock in those rates for the long term. Consider refinancing your existing home loan or securing a fixed-rate loan to protect yourself from potential future rate hikes.

Important to remember: While lower interest rates offer exciting opportunities, it's crucial to borrow responsibly. Don't be tempted to take on more debt than you can comfortably manage, even if it seems more affordable.

See our infographic on how to navigate interest rate cuts

How to make the most of lower interest rates

- Review your existing loans and see whether refinancing can save you money and where you can afford to pay off a loan sooner.

- When interest rates are lower, you could qualify for larger loans that make big purchases possible, and it might be a good time for that renovation or vacation.

- Budget wisely and borrow responsibly. Even with lower payments, you’ll still have to pay the money back.

Before making any financial decisions, carefully consider your current financial situation, your long-term goals and the terms and conditions of any loan you're considering. By understanding the impact of interest rate changes and making informed choices, you can navigate the financial waters with confidence and make the most of the opportunities they present.

Use our personal loan calculator to estimate the impact that lower rates can have on your current loan and monthly repayments, and how that can influence your finances.

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.