Budget vs straight: Understanding your credit card

Whenever you swipe your credit card in-store, you’ll most likely be asked whether you want to make the purchase ‘budget or straight’. The bank provides these payment facilities to give you options for how you plan to pay and how you’d prefer to structure the interest.

It’s crucial to understand the difference between the budgeting and straight facilities of your credit card so you can make informed financial decisions that enable you to manage your finances better and avoid unnecessary debt.

Here’s a closer look at using your credit card’s budgeting facility:

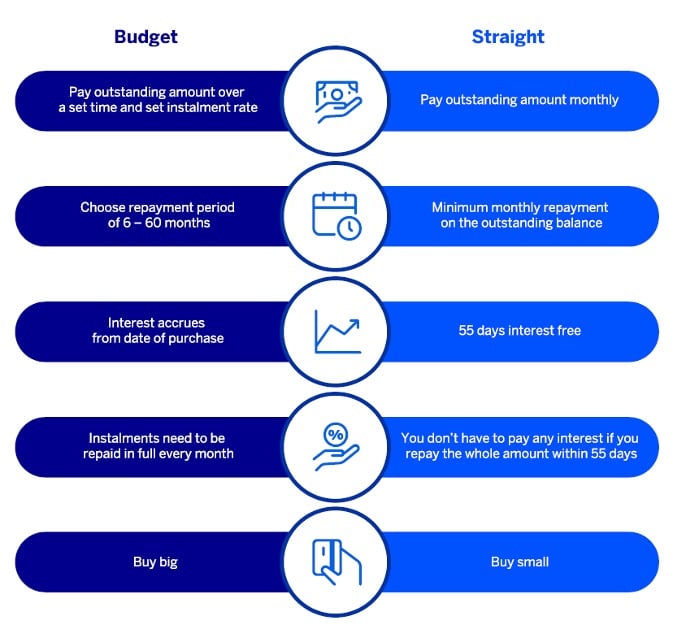

The difference between budget and straight facilities

The straight facility is your typical credit card purchase. You pay the full amount within your credit card's interest-free period (usually up to 55 days) and avoid paying any interest. The 'budget' facility, on the other hand, turns your purchase into a mini loan, spreading the cost over a set period with interest.

Let's break that down further:

Straight facility: You're using your credit card as a convenient payment method but with the added benefit of a grace period. If you pay your statement balance in full and on time each month, you won't incur any interest charges. This is the ideal way to use your credit card to maximise its benefits and avoid unnecessary costs.

Budget facility: This is designed for larger purchases that you want to pay off over time. Think of it as a short-term loan attached to your credit card. While it offers the convenience of spreading out payments, it's important to remember that you'll be paying interest on the outstanding balance.

Explore the basics of credit cards and how to use them as a financial tool

When to use the budget facility

- When you select the budget facility, it spreads the cost of the purchase over a longer time and acts like a term loan, such as a personal loan. The benefit is that you’ll know exactly how much it will cost you and by when it needs to be paid off.

- You can only choose the budget facility on purchases of R200 or more and then decide on a repayment period of up to 60 months. Remember that you’ll still be charged interest over that time and, therefore, you should weigh up the initial saving with the total cost of purchase.

- If you’re paying for a large and expensive item, such as an appliance, furniture or jewellery, and plan to pay it off over a few months, buying it ‘on budget’ could make it easier to manage your monthly expenses, but for smaller purchases that can be repaid faster, it would be better to choose the straight facility and pay it off within the 55-day period so that you don’t incur any additional costs.

Learn more about the difference between credit cards and personal loans and when to use them.

|

Top tip Try to settle the debt as soon as possible. There is no penalty if you pay off the amount before the selected repayment term. |

Note: you can’t use your budget facility to buy foreign currency, traveller’s cheques or progressive payments, such as your home loan.

*Terms and conditions apply

Disclaimer: This article is solely intended for information. It does not constitute financial, tax or investment advice or recommendation. Please speak to a financial advisor or registered financial professional before making any financial decision(s).

Standard Bank, its subsidiaries or holding company, or any subsidiary of the holding company and all of its subsidiaries make no warranties or representations (implied or otherwise) as to the accuracy, completeness or fitness for purpose of the information provided in this article or that it is free from errors or omissions.