(sum)1 Banking Account

It's never too early to spark your child's interest in saving and spending wisely. Our (sum)1 Account, designed for kids under 16, comes with fantastic perks and a bank card with zero monthly fees.

Need help?

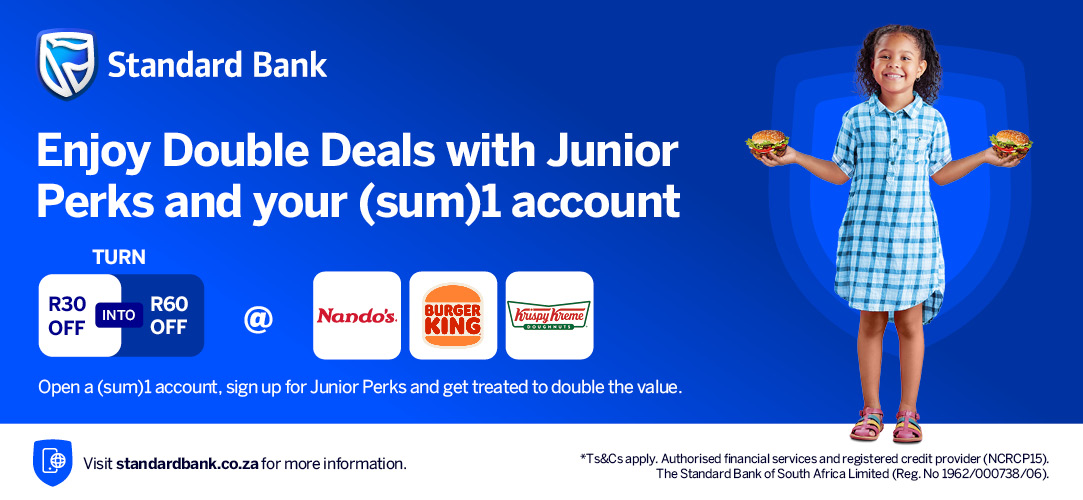

- Exclusive access to Junior Perks so you can spoil your kids at their favourite retailers like Krispy Kreme, Nando’s & Burger King. Plus, get free movie tickets at Ster Kinekor

- Bank card with automatic lost card protection

- Unlimited free swipes at till points

- 10 Free electronic debit transactions a month, including:

- Prepaid airtime purchases

- Electronic inter-account transfers

- Electronic account payments

- Free cash withdrawals up to R1 000 at our ATMs

- Free cash deposits at our ATMs of up to R1 500

- Free balance enquiries when you dial *120*2345#

- Notifications on transactions via MyUpdates

*T&Cs apply

Sum1 – Double Value Campaign T&Cs

Personal transaction accounts T&Cs

General T&Cs

- No monthly fee

- Pay as you transact rates apply after you have used your bundle services for the month.

As a parent, you don’t need to bank with us to open an account for your children.

- You can complete the Call me back form

or - You can visit your nearest branch and bring the following documents:

- Your child’s birth certificate*

- Your ID (parent or guardian)

- Proof of residence not older than 3 months

*You must be under 16, and be an SA citizen

-

What you get

-

What it costs

-

How to get it

- Exclusive access to Junior Perks so you can spoil your kids at their favourite retailers like Krispy Kreme, Nando’s & Burger King. Plus, get free movie tickets at Ster Kinekor

- Bank card with automatic lost card protection

- Unlimited free swipes at till points

- 10 Free electronic debit transactions a month, including:

- Prepaid airtime purchases

- Electronic inter-account transfers

- Electronic account payments

- Free cash withdrawals up to R1 000 at our ATMs

- Free cash deposits at our ATMs of up to R1 500

- Free balance enquiries when you dial *120*2345#

- Notifications on transactions via MyUpdates

*T&Cs apply

Sum1 – Double Value Campaign T&Cs

Personal transaction accounts T&Cs

General T&Cs

- No monthly fee

- Pay as you transact rates apply after you have used your bundle services for the month.

As a parent, you don’t need to bank with us to open an account for your children.

- You can complete the Call me back form

or - You can visit your nearest branch and bring the following documents:

- Your child’s birth certificate*

- Your ID (parent or guardian)

- Proof of residence not older than 3 months

*You must be under 16, and be an SA citizen

Learn to make the most of your new card.

Making changes to your card is quick, safe and easy when you know how.

Using your card is one of the safest ways to pay, but you should always take precautions.

Using a credit or debit card gives you various payment options.